US Election 2016: Asia Markets Tumble on Vote Results

24×7 Around the Globe

Image copyrightGETTY IMAGESImage captionMore than nine million tweets were collected as part of the study

Image copyrightGETTY IMAGESImage captionMore than nine million tweets were collected as part of the study Image captionThe US dollar is up more than 10% against the peso

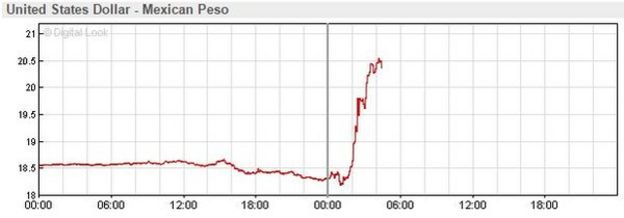

Image captionThe US dollar is up more than 10% against the peso