What are the Paradise Papers?

The Paradise Papers are a huge leak of financial documents that throw light on the top end of the world of offshore finance.

A number of stories are appearing in a week-long expose of how politicians, multinationals, celebrities and high-net-worth individuals use complex structures to protect their cash from higher taxes.

As with last year’s Panama Papers leak, the documents were obtained by the German newspaper Süddeutsche Zeitung, which called in the International Consortium of Investigative Journalists (ICIJ) to oversee the investigation. BBC Panorama and the Guardian are among the nearly 100 media groups investigating the papers.

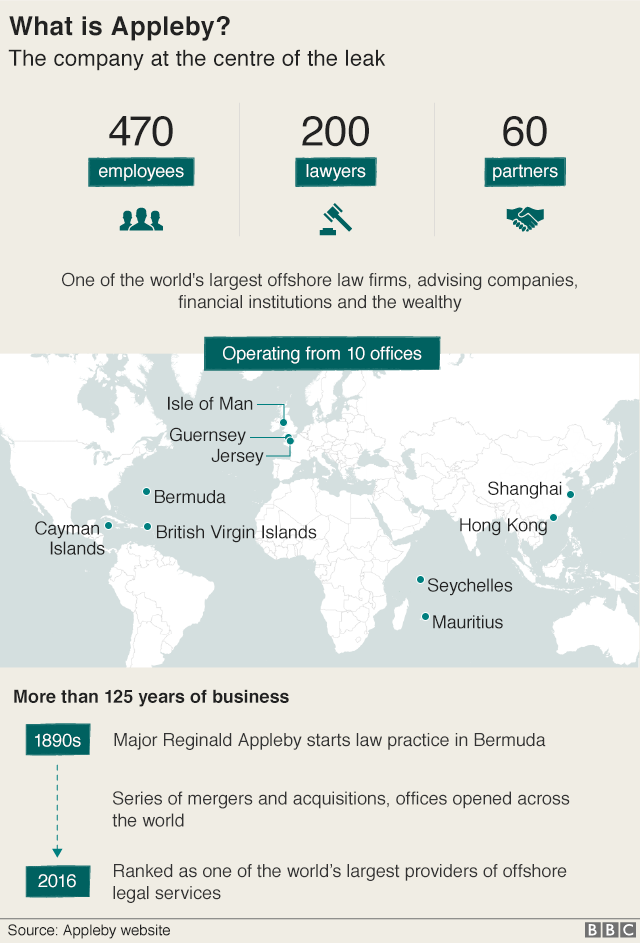

The Paradise Papers name was chosen because of the idyllic profiles of many of the offshore jurisdictions whose workings are unveiled, including Bermuda, the HQ of the main company involved, Appleby. It also dovetails nicely with the French term for a tax haven – paradis fiscal. Then again, the Isle of Man plays a big part.

Who is being exposed?

The offshore financial affairs of hundreds of politicians, multinationals, celebrities and high-net-worth individuals, some of them household names, have been revealed. The papers also throw light on the legal firms, financial institutions and accountants working in the sector and on the jurisdictions that adopt offshore tax rules to attract money. The top stories so far include:

-

Apple has protected its low-tax regime by using the Channel Island of Jersey

-

Formula 1 champion Lewis Hamilton avoided tax on his £16.5m luxury jet, the papers suggest

-

The Queen’s private estate invested about £10m offshore including a small amount in the company behind BrightHouse, a chain accused of irresponsible lending

-

One of President Donald Trump’s top administration officials kept a financial stake in a firm whose major partners include a Russian company part-owned by President Vladimir Putin’s son-in-law

-

A Lithuanian shopping mall partly owned by U2 star Bono is under investigation for potential tax evasion

-

How three stars of the hit BBC sitcom, Mrs Brown’s Boys, diverted more than £2m into an offshore tax-avoidance scheme

-

One of the world’s largest firms loaned a businessman previously accused of corruption $45m and asked him to negotiate mining rights in a poor central African nation

-

The Isle of Man passed a law that would help tax evaders, the documents show

-

A key aide of Canada’s PM has been linked to offshore schemes that may have cost the nation millions of dollars in taxes, threatening to embarrass Justin Trudeau

-

Lord Ashcroft, a former Conservative party deputy chairman and a significant donor, may have broken the rules around how his offshore investments were managed. Other papers suggest he retained his non-dom tax status while in the House of Lords, despite claiming to have become resident in the UK

-

How questions were raised about who is controlling Everton FC

-

An oligarch with close links to the Kremlin may have secretly taken ownership of a company responsible for anti-money laundering checks on Russian cash

-

How a UK company exploited an anti-tax avoidance law to actually save itself tax